Asim Riaz

Energy Expert and Strategist. Experience in Energy Policy Planning, Energy economics, pricing and tariff, Energy projects development, LNG, LPG, RLNG, Gas and Coal Sector, Power generation, Environment, sustainability and Climate Change issues.

The potential consequences of Houthi or proxy forces targeting vessels in the Strait of Hormuz, possibly with drones or Gaza-style rockets, are significant. While these attacks might not cause extensive physical damage, their impact on market sentiments could be substantial. Given that 20% of the world’s oil and gas passes through this strategic chokepoint, any disruption in the area could lead to a steep increase in oil and gas prices. This situation poses a particular risk to countries like Pakistan, which heavily rely on Middle Eastern oil. Pakistan’s vulnerability is exacerbated by its lack of diversified energy sources and ongoing economic challenges, making it especially susceptible to disruptions in oil supply.

2. The Houthis and their proxies, who are at war with Saudi Arabia, could be utilized by Iran in response to threats from Israel. These proxies have previously attempted to target Saudi facilities with drones. While Iran has the capability to export oil partially from locations outside the Strait of Hormuz, neighboring countries like Iraq, Kuwait, Qatar, Saudi Arabia, and Bahrain do not. Merely creating disruptions at Hormuz could drive oil prices higher, benefiting Iran economically. Due to the embargo, Iran’s oil prices are relatively low, and any disruption would improve their economic situation. However, such a scenario is more likely to arise if the conflict spreads beyond Gaza. As long as the conflict remains contained within Gaza, it’s unlikely that these proxies will be used near the Hormuz Strait.

3. However, targeting the Strait of Hormuz by Houthis, which risks damaging the economies of allies like Iran (and neutral states like Qatar), seems counterintuitive when their aim is to impact Israel’s economy. Disrupting this vital route would hurt Iran and Qatar also, who depend on it for oil and LNG exports, potentially straining alliances and undermining shared objectives. Such actions could also provoke global economic repercussions and backlash, raising questions about the strategic logic behind harming crucial allies and neutral states while intending to target Israel.

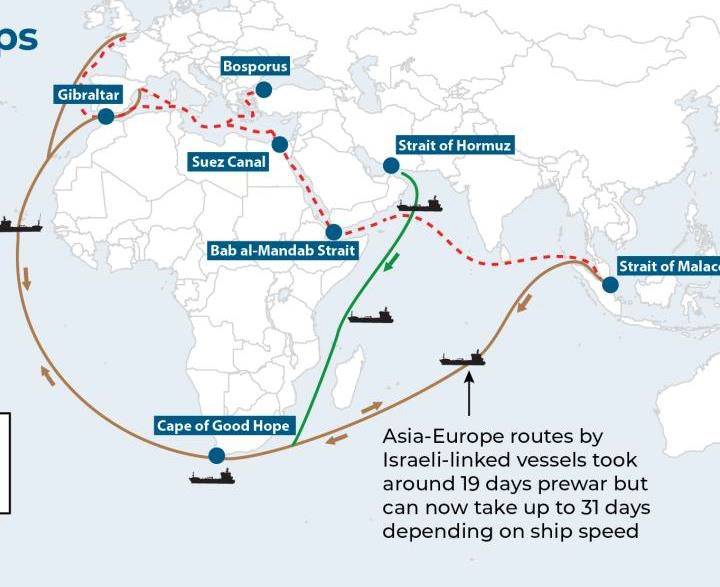

The Red Sea

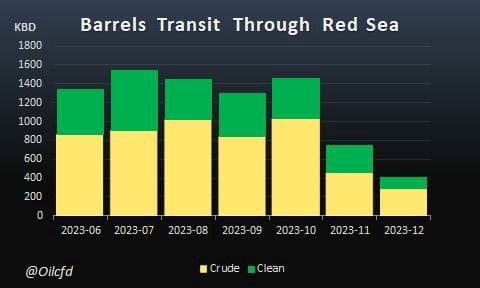

The Red Sea and Houthi situation presents a complex challenge for the Biden administration, particularly as oil tankers start to avoid the region. This development raises concerns about the U.S.’s ability to defend freedom of navigation. Any perception of weakness in this area could have significant geopolitical consequences. However, a forceful response might escalate the conflict and drive oil prices higher, a scenario the Biden administration is keen to avoid, especially with an election year approaching.

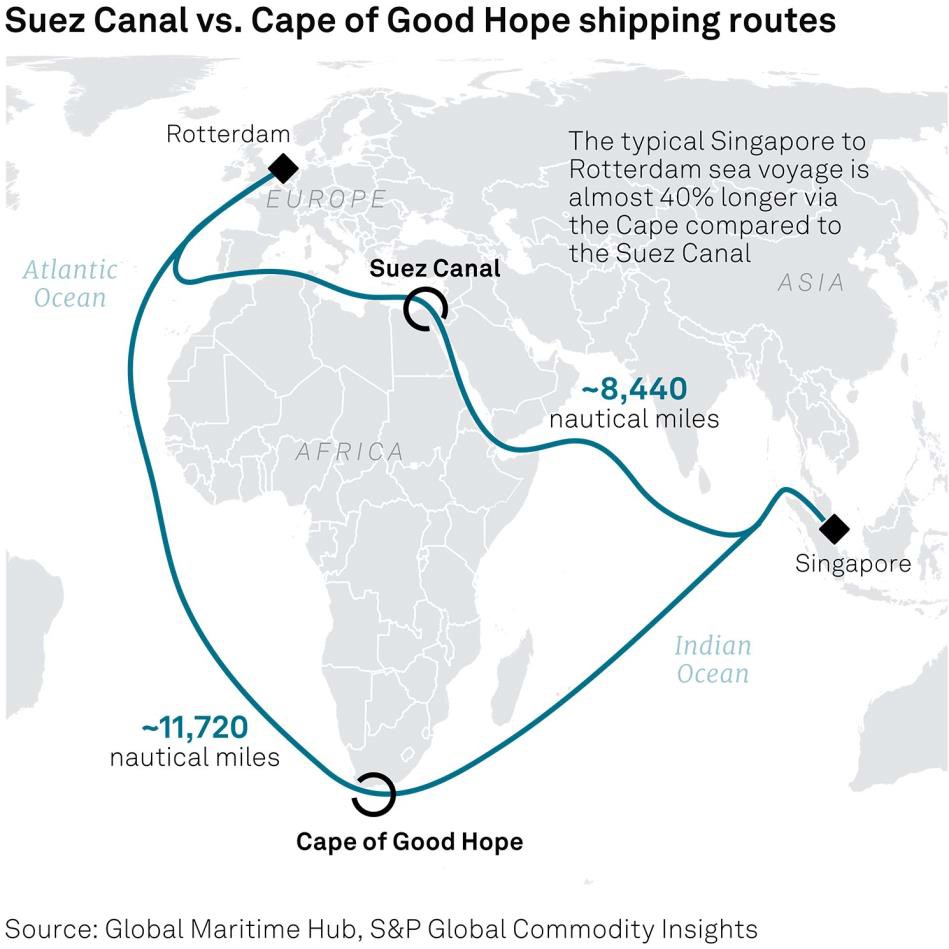

2. In terms of the oil market’s current reaction, the situation is mostly causing inconveniences, such as slight price increases and additional shipping costs, rather than posing a direct threat to oil supplies. The issue is more critical for LNG, especially for countries like the UK, which have limited storage capacity. In a scenario similar to the ‘Beast from the East’, where natural gas demand surges unexpectedly, the current situation could exacerbate supply challenges.

3. The dilemma for President Biden is balancing the need to respond effectively without causing a spike in oil prices. Direct military action, like striking Houthi launch sites, carries the risk of such a price hike. Thus, the administration faces a tricky situation: it cannot ignore the issue indefinitely, nor can it rely solely on running endless convoys, particularly when economic and political stakes are so high.

4. A different perspective on the Red Sea and Houthi situation. It challenges the idea that the Houthis, or even Iran, are responsible for the issues affecting oil tankers in the region. Instead, the response hints at a possible orchestration by the United States to involve External Regional Forces (ERFs), potentially leading a coalition with India at the forefront. This viewpoint presents a complex geopolitical landscape, where actions and events might be part of a larger strategic plan by major powers, particularly the U.S. The idea here is that such maneuvers could be aimed at justifying the formation of an international coalition, possibly to achieve broader goals in the region. This analysis reflects a deep analysis of geopolitical strategies, suggesting that surface-level events might be influenced by more significant, underlying geopolitical objectives.